My dad started collecting Social Security when he turned 70. He turned 100 this year and I remarked, “You realize you’ve been collecting Social Security for 30 years?” Who could have predicted such a thing? I’m thankful and so is he, but when he started collecting he had no way of knowing he’d celebrate a full century on the planet.

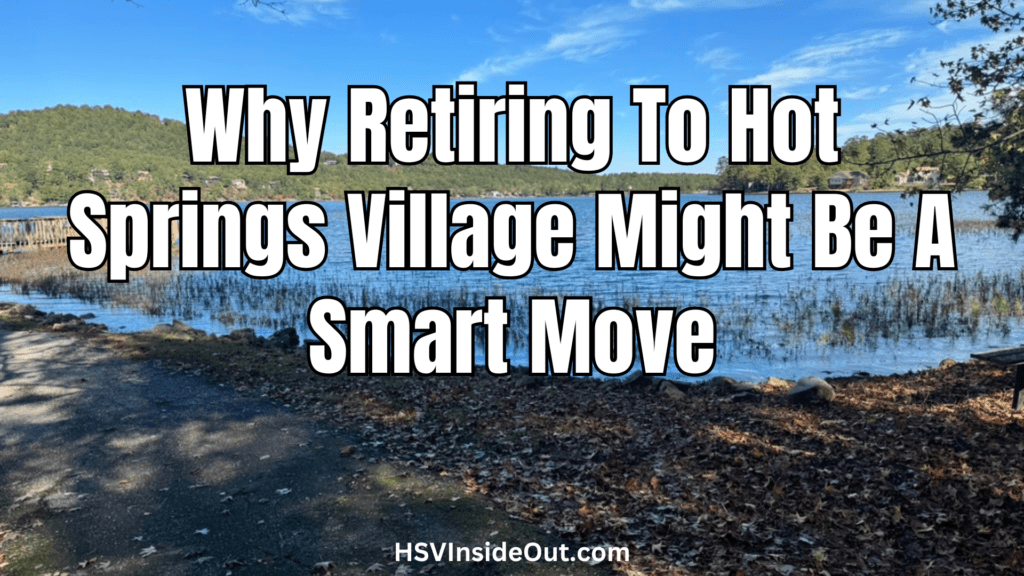

Retirement is a big topic for folks our age. When Dennis and I began this online show, Hot Springs Village Inside Out, the first folks we began to hear from were people looking for a place to retire. Mostly, people were looking for a nice, temperate climate, secure, cost-effective place. Enter Hot Springs Village. I made it clear from the get go that I was in love with the Village. It was the driver behind starting our podcast and online video show. I wanted to shine a bright positive light on this place I now loved. I had no desire to join in the handful of ninnies who enjoyed the social media notoriety of complaining, whining and throwing others under the bus. I had already discovered, long before I started our show, that these folks were a super minority. In fact, they were so rare I had never met any of them in person. I still haven’t and don’t plan to.

Dennis and I started getting feedback from our audience. Never reluctant to share our opinions of the good and the not-so-good aspects of the Village, we aimed to give people our insights so they could decide for themselves. Mostly, we encouraged – and still encourage – people to visit and figure it out for themselves. It’s a professional habit I have, helping people figure it out – not by telling people what to do, but by helping them figure out what they want to do! Dennis and I have stayed true to that part of our program and in our interactions with people who contact us.

Retirement has many different looks. For us, it means we’re at that magical age where we can collect Social Security that we’ve paid in all our working lives. It doesn’t mean not working though. Our work looks different than it did when we were 40 or 50, but we’re still focused on providing enough value to others that it’s worth being paid something. It has nothing to do with needing to fund some lavish lifestyle, but it has more to do with what we want to do with our time. And who we want to serve. I’ve got clients and audiences (I have 3 podcasts) who matter a lot to me. I want to provide increasingly more value, not less. And as a capitalist, I’m not opposed to earning a few dollars – certificates of appreciation – along the way. Almost everybody I know who is retired or approaching retirement is very interested in earning supplemental income. That’s likely a sign of our times!

Years in business have made me a bit of a spreadsheet junkie. Sometimes.

I’m hardly a Microsoft Excel expert, but in the early days of computers (yes, Virginia, I’m that old), I learned there were 2 pieces of software that would change my decision-making abilities for the better. Spreadsheets and Databases.

Nobody I knew had heard the term “analytics” but we quickly learned from the big shot, smarty pants who were paving the way. We were all used to analyzing numbers using handwritten accounting ledgers and calculators that had paper tape so you could review what you had calculated. Colored pencils helped, too.

Some of us (my hand is in the air) adopted computer technology and adapted to the high value brought to us by accounting, inventory management and point-of-sale software. I leaned hard into enterprise technology solutions in 1982 when I hired custom coders to create a point-of-sale retail solution that had features I never dreamed would be available. By today’s standards, that first system looked like two tin cans and a length of string compared to the most recent Apple iPhone. You should also know we were beginning to use plain paper fax machines about this time – and we thought that was the bomb because we no longer had to make photocopies of thermal paper faxes (something we learned to do when we realized all that thermal paper eventually just turned into blank paper once the faxed images faded). I told you, I’m old. 😉

Given that background it shouldn’t be a shock that I have long relied on spreadsheets for personal decisions, especially personal finance decisions. Sometime in 2021 I started a spreadsheet in anticipation of selling our house in Texas, a house we’d lived in for over 20 years. It began with one line of various projected selling prices. Then I added the amount of commission and other costs associated with selling. I created a row that calculated what our net profit would be at all the various selling prices. I was planning for as many possible scenarios as I thought were reasonable.

I should tell you that this was after visiting with our real estate agents, a young couple we knew – and a family we had worshiped with for years. We had a very accurate notion of what our selling expenses would be. That was vital as I created my first “get to Hot Springs Village” spreadsheet. It would be the first of about four spreadsheets I’d create and noodle with as we embarked on our path forward toward Hot Springs Village.

That’s the technical context of our journey, but there’s some more personal background that will help me share my story.

My wife and I are both 66. Our birthdays are one month apart. Yes, I’m older! 😉

In play for us was Full Retirement Age, an age where people can collect the maximum amount of their Social Security benefits (yes, people can wait until they’re 70 and achieve the true maximum, but FRA – Full Retirement Age – also has benefits allowing recipients earning benefits beyond what they collect in Social Security). Based on our dates of birth we both reach that magical FRA at the end of this year, 2023.

It’s our second big milestone, the first one being when we turned 65, which qualified us for Medicare, the national healthcare insurance available for folks reaching retirement age. Never mind that I’m not going to retire. Dad loves his work so why would I stop? With more than a year of Medicare under our experience belt we figured navigating this Social Security journey would be a breeze. And we were right. Thanks to the online information available at https://www.ssa.gov/myaccount/, people can access their benefit status. We had been keeping up-to-date on our status for a few years, so by the time I began developing a spreadsheet to compute our future income and expenses, we both had a fairly accurate of what our Social Security benefits would be once we hit FRA and hit the gas to start collecting our benefits.

The spreadsheet for selling our house proved most useful as we targeted net proceeds from the sale and began computing what we might do with those funds. We were mortgage free so we were preparing for what would become our biggest windfall (okay, it wasn’t quite a windfall because we’d been paying for years to put ourselves in this position, but that’s the best word I know to describe the numbers). It wasn’t going to be some astronomical amount that would put us among the top 1% or even among the top 10 or 20 percent…but for us, it was significant enough that we wanted to behave as wisely as possible. There were no thoughts of lavishing ourselves with toys we’d never had, or some fantasy lifestyle. We’re both frugal, simple people who have never been impulsive or careless with money. Now certainly wasn’t the time to change that. Besides, it was just who we were – and who we’d always been. It was also who we planned to be now that we were old.

I had embraced practical minimalism for about a year as I purged possessions, readying our house to sell. Practical is how I describe my passion for minimalism because I’m not intent on having one plate, one fork, one spoon and one knife. I do have a favorite fork or two, but I’m more practical in my approach than folks who may just want a house with the bare necessities and no more. I appreciate true minimalists and I don’t judge them. I just don’t want to practice minimalism to quite that extreme. For me, I want things I use daily, weekly, monthly or annually. That gives me the allowance to keep flannel shirts even when during a 100 degree summer. No, I don’t wear them then, but Lord willing, when fall and winter roll back around I’ll have them to drag out. Why buy new flannel shirts every year when I can keep the ones I’ve got to wear each year? Sentimental things are the exceptions, but I can now honestly tell you that every possession I have is used daily, weekly, monthly or annually – even sentimental things. For example, my podcasting and work space is dubbed The Yellow Studio. I created that space around 2000 and while the location has changed a few times, I’m up to The Yellow Studio 4.0. Inside The Yellow Studio is artwork and various knick-knacks that I value. I look at them daily so they matter to me.

The spreadsheet that became most important was the one I leaned on after we sold the house. Armed with the funds from the sale, I began using this other spreadsheet for various investments, expenses and income possibilities.

Within weeks of closing on selling our Texas house we made an offer on a new house inside Hot Springs Village. That wasn’t the plan, but serendipity happens and we leaned into it. We weren’t looking to purchase a house inside the Village, but when opportunity knocks, you’d best answer. We answered and found ourselves closing on a new house in the Village just two days after selling our Texas house. While that took a good portion of our proceeds, it didn’t take all of it. And it had zero impact on our budget – well, almost zero. I mean we went from one house without a mortgage in Texas to another house without a mortgage in Arkansas.

So I’ve got this spreadsheet going to compute all our expenses and all our projected income. Spreadsheets provide “what if?” scenarios. What if we earn this much? What if we earn that much? What if our expenses are this? What if our expenses are that?

I plugged in real numbers based on our current situation. For example, my utilities were based on actual annualized numbers. Ditto for insurance and groceries and everything else. I calculated our current costs averaged for the most current quarter or so, then annualized them to give me a monthly average amount. That monthly average amount went into the spreadsheet for that line item.

According to SoFi’s website, the average cost of living in Texas is $45,114 a year. That’s $3,760 a month, per person, on average. A big chunk of that is in housing and utilities. Remember, we were mortgage free in Texas, but since Texas has astronomical property taxes we were paying over $8,000 a year in property taxes – for a house we owned outright. I’m not going to go line by line down my spreadsheet, but the point is we have these big line items that can change everything. For the good. Or the bad. Not owning property in Texas was the biggest financial plus for us and it may be that way for you, depending on where you’re coming from. Home owner’s insurance costs were also dramatically lower in Arkansas versus Texas. The national average cost of living is just a bit over $38,000 a year. The average cost of living in Arkansas is currently just over $33,000. Do your own math and you’ll be able to calculate what a move to HSV might mean for your finances.

In the past few years I’ve met more folks who moved to the Village from California and Texas than anywhere. Nothing scientific or statistically valid about that, but it does represent two states that aren’t known for their low cost of living, even though Texas has no state income state. Full disclosure, Rhonda and I remain Texas residents because live in DFW more than we live in Hot Springs Village. My clients are in Texas and Rhonda’s employer is there. Most importantly, our grandkids and other family are there so it’s important for us to remain present in Texas. Our primary residence based on ownership is only inside the Village. We don’t own property in Texas even though we live the majority of our time there. It’s cheaper for us to rent there and own here. Your situation may be very different, but the math still doesn’t lie and hopefully you’ll be able to figure out your situation based on the things we discovered as we were figuring out our situation.

Comparing apples to apples the numbers started jumping off the page. For us, a married couple living a mortgage free and debt free life moving to the Village represented an annual difference of over $20,000. It was closer to $22,000. Armed with that number we were able to make a smarter decision. And that’s just the math part of the decision, but for people our age that’s a major factor that few of us can ignore.

Depending on where you’re coming from the probability is very high and that your cost of living in Arkansas will be lower than wherever you’re coming from. That’s why this spreadsheet exercise was so important for us. The numbers don’t lie.

Then there are all those priceless things like quality of daily life. For me and Rhonda Hot Springs Village provides a serenity and pace unavailable to us in DFW. The walking. The sense of community. The new people entering our life from places like Nebraska, Iowa, Massachusetts, Florida and even Texas. The local business owners we’re getting to know. Nature. Trees. A topography unlike anyplace we’ve ever lived before. Our neighborhood, a lake community. The wildlife. I can’t spreadsheet any of that because it’s priceless.

For us, there’s only one real downside to being 66 and living inside the Village. We’re 5 hours away from our family, but it’s only 5 hours. I know not everybody is facing that situation. Some people inside the Village are clear across the country from family. Others are closer than we are. That’s why considering a move to Hot Springs Village (or any other place) is a personal, individual decision that nobody can make for you. And it can be hard, even if it’s a place you love like we love the Village.

For us, given all the moving parts that make up our life – work, family, church and finances (not necessarily in that order) – living in two places is the best solution, giving us the best of both worlds.

Early on after starting our show I did a commentary on a documentary about The Villages in Florida, a very popular retirement destination. I’m sure for some people it’s the ideal place to be. A golf cart community where people get around using golf cart paths. Where there is such a thing as rush hour on the golf cart paths. Tons of clubs. Lots of activities. Tons of golf. A place that continues to grow by leaps and bounds, proving that it appeals to a lot of people. I applaud those folks who love it and call it “home.” But nothing about it appeals to me and Rhonda. A place like that checks not a single box for us. But that’s us.

Maybe there’s the rub…figuring out what we most want. That may be a big challenge for some of us. Rhonda and I didn’t struggle with that. About 3 years ago while sitting on the back patio of an Airbnb on an HSV golf course I remarked, “I could spend an awful lot of time here.” She instantly said, “Me, too.”

And we were off, conspiring and planning our escape from DFW so we could spend more time inside Hot Springs Village. For us, it made sense in every way. Cost of home ownership? Much less. Quality of life? Much higher. The things we value most? Check.

I guess it’s like most things in life. We get what we put into it. We make of it what we will. Albert Einstein reportedly said, “Fish don’t climb trees.” Meaning it’s best if we know who and what we are. Are we people who love all that HSV represents and the things that dominate life here? Are we people who need and crave something very different?

I’m not the sharpest knife in the drawer, but I know I’m a knife.

I encourage you to come visit. Spend time here, as much time as you can spare. Don’t just come once. Come over a few times. Stay in different places. For us, it took at least four trips – one week at time – before we really had a sense of the place. We were smitten as soon as we arrived inside the gates, but we were in love by the end of our 4th week here. Big decisions deserve big effort and the time required to get it right.

I’ve not yet met anybody who regrets coming here. I have met a number of people who, for various reasons, had to leave to get closer to family. Each of them knew it was the best decision, but they each hated leaving the Village. So from Dennis and me – and all of our podcast community – we wish you the best as you do whatever calculations are necessary so you can figure out your path forward. If it brings you to Hot Springs Village, then please reach out and let us know you’re new here. If it takes you elsewhere, then you still win – and that makes all of us benefit from your wise choice.

Podcast: Play in new window | Download (Duration: 40:09 — 18.4MB)

Subscribe: Apple Podcasts | Spotify | Amazon Music | Android | iHeartRadio | RSS | More

• Join Our Free Email Newsletter

• Subscribe To The Podcast Anyway You Want

• Subscribe To Our YouTube Channel (click that bell icon, too)

• Join Our Facebook Group

• Tell Your Friends About Our Show

• Support Our Sponsors

(click on the images below to visit their websites)

__________________________________________